The Access Formula

Offered by Access Private Wealth Corp.

We’ve developed and refined a proprietary planning framework we call the Access Formula – our disciplined approach to guiding clients through complexity, addressing critical life and wealth events, and helping you move forward with clarity and confidence.

Our Company

Established in 1998, Access is a team of Private Wealth Managers, Portfolio Managers, and Financial Planners serving a select group of professionals, business owners, and families.

We provide comprehensive wealth management within the context of long-term partnerships, guided by clear expectations, disciplined planning, and coordinated strategy – helping clients achieve their financial and legacy objectives over time.

Why We’re Different

DEMOCRATIZING ACCESS

The Power of Access lies in disciplined planning, institutional-quality investment management, and coordinated strategy - designed to help families build, preserve, and steward wealth over the long term.

CUSTOMIZED APPROACH TO BUILDING PORTFOLIOS

Our portfolio construction process is planning-led and intentional - designed within the context of your broader financial picture to ensure investment decisions align with your objectives, constraints, and long-term strategy.

FEES ARE SIMPLE AND TRANSPARENT

Our fee structure is designed to be clear and straightforward, so clients understand how fees are calculated and how they relate to the services provided. Transparency supports informed decision-making and long-term trust.

ACCESS FORMULA

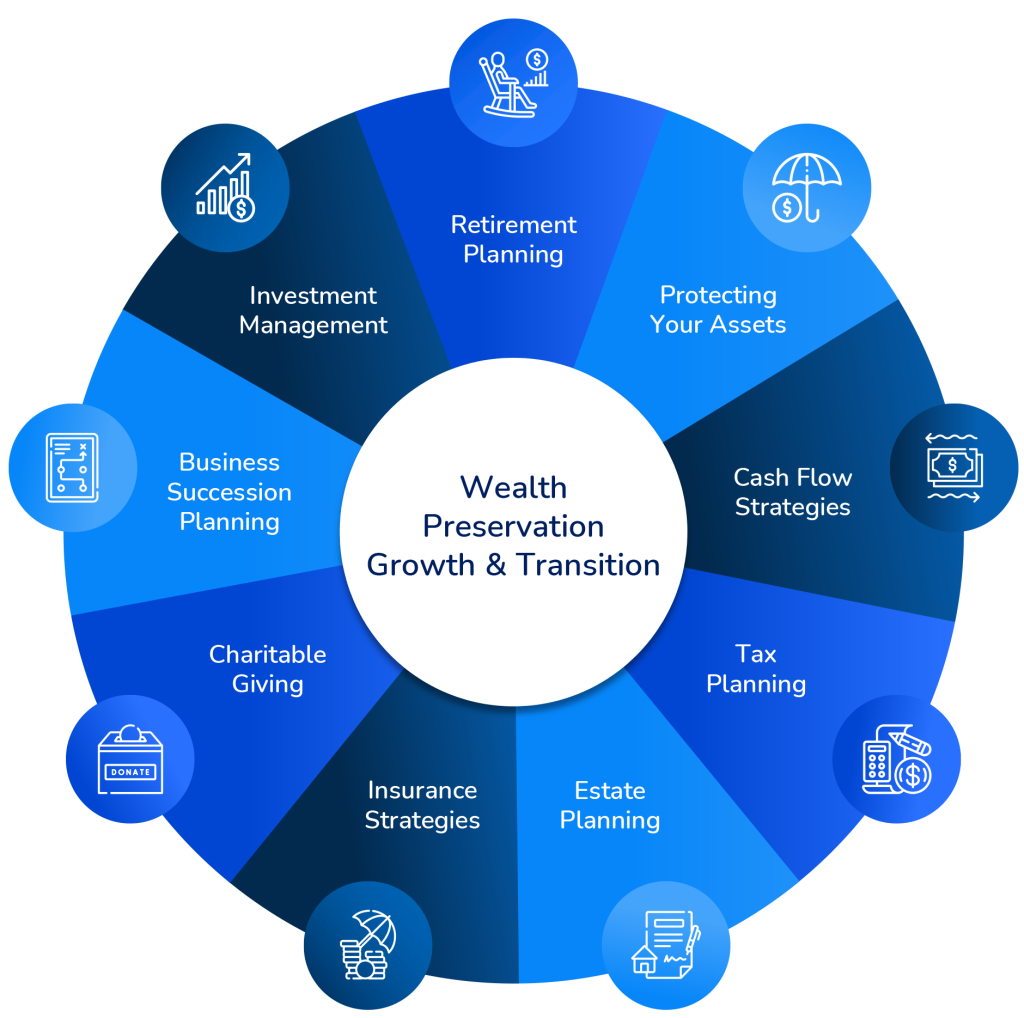

The Access Formula is our proprietary planning framework, developed and refined to integrate every aspect of a client’s financial life as circumstances evolve over time.

Access Formula

Step 1

Understanding What's Important To You

Our process begins with a clear understanding of your family’s long-term objectives, values, and priorities. This foundation informs every planning and investment decision, ensuring recommendations remain aligned with what matters most over time.

Step 2

Financial Assessment & Base Plan

This collaborative stage focuses on gathering and organizing relevant financial information to establish a clear baseline of your current position and potential long-term outcomes. Using prudent, planning-based assumptions, we develop an initial framework that informs future planning and decision-making.

Step 3

Plan Review & Collaboration

This stage involves a detailed review of the base plan to confirm accuracy, validate assumptions, and ensure all relevant information has been captured. Collaboration at this point helps refine the plan and establish alignment before moving forward to implementation.

Step 4

Strategies & Recommendations

At this stage, we evaluate and develop planning strategies designed to enhance tax efficiency, improve income coordination, and support the orderly transition of personal and corporate assets over time. Recommendations are considered within the context of your broader financial structure and long-term objectives.

Step 5

Implementation

Once strategies and timelines are agreed upon, we coordinate implementation in collaboration with your existing professional advisors or, where appropriate, with trusted specialists aligned with our team. Our role is to ensure execution remains organized, timely, and consistent with the broader plan.

Step 6

Roadmap for Future Meetings

We establish a customized roadmap for future meetings to ensure each discussion is purposeful, structured, and aligned with defined planning objectives. This approach supports continuity, accountability, and progress over time.

Step 7

Ongoing Monitoring

Ongoing monitoring ensures your plan remains aligned as markets, regulations, and life circumstances evolve. Through regular review and oversight, we coordinate the many moving parts of your financial structure so decisions remain informed, timely, and consistent with long-term objectives.

This approach allows clients to maintain focus on the broader picture while we manage complexity, execution, and follow-through behind the scenes.

Power of Access

Large institutional investors such as pension funds benefit from broad diversification, disciplined governance, and access to a wide range of investment strategies beyond traditional public markets.

At Access, our investment approach is designed to extend similar structural advantages to qualifying clients by incorporating public, private, and alternative strategies where appropriate. This broader opportunity set can support diversification, improve risk management, and enhance portfolio construction when integrated thoughtfully within a long-term plan.

Access to these strategies is not about chasing returns—it is about building resilient portfolios through structure, discipline, and careful allocation.