Our Services

Tax & Financial Planning

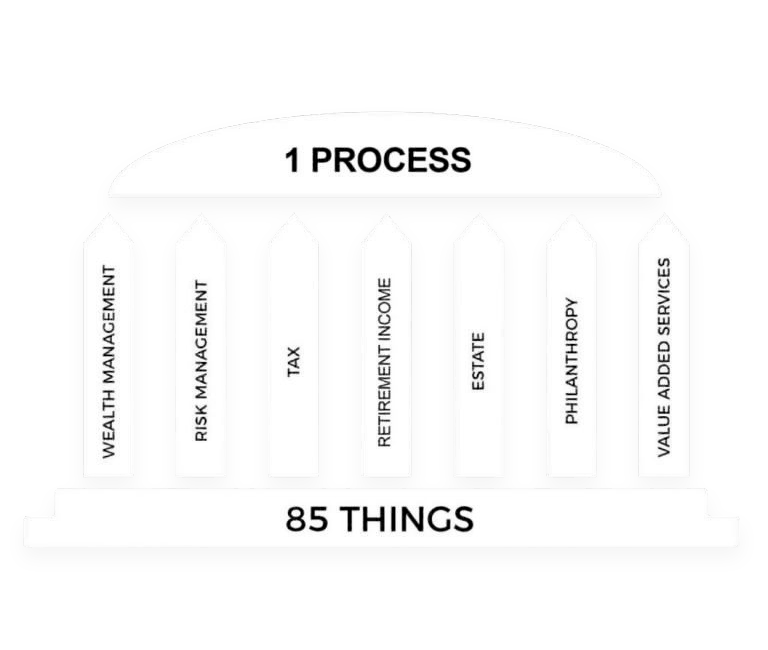

The Access Formula

Managing your net worth involves far more than simply holding your investment accounts. We have developed and refined an award winning process we call The Access Formula that puts every piece of the financial puzzle together for our clients as their lives unfold and needs evolve. This process is supported by 7 financial pillars and ensures that our team is there to guide clients through all of life’s critical events so they can look forward with confidence. It’s fluid and dynamic, not static or transactional.

We understand that you can’t build a puzzle without the picture, and our process allows clients to focus on the picture, while we take care of all the pieces. Discover the difference our process can make in your life.

Tax Planning

No one enjoys paying taxes. After all, wouldn’t you rather keep more of your investment capital and income for you and your family?

Our team of financial professionals understands the tax implications that successful investing can bring, and will use every tax advantage and strategy available to minimize your tax burden. We’ll measure the tax efficiency of both your registered and non-registered accounts, as well as any investment cash flow, and make the adjustments that will protect as much of your money from the taxman as possible. Access Private Wealth will also work with your other professional advisors to find the best solutions for your family.

Our tax planning strategies include advice and guidance on:

- Income splitting to reduce income taxes

- Pension splitting with your spouse on your tax return

- Sharing CPP benefits and RRSP contributions

- Registered Education Savings Plans (RESP)

- Registered Disability Savings Plans (RDSP)

- Graduated Rate Estates (GREs)

- Prescribed rate loans

- Family trusts

- Strategies for splitting business income

We can also provide you with handy tips to save even more tax, such as deducting interest on investment or business loans, investment counsel fees, capital gains exemptions, and more.

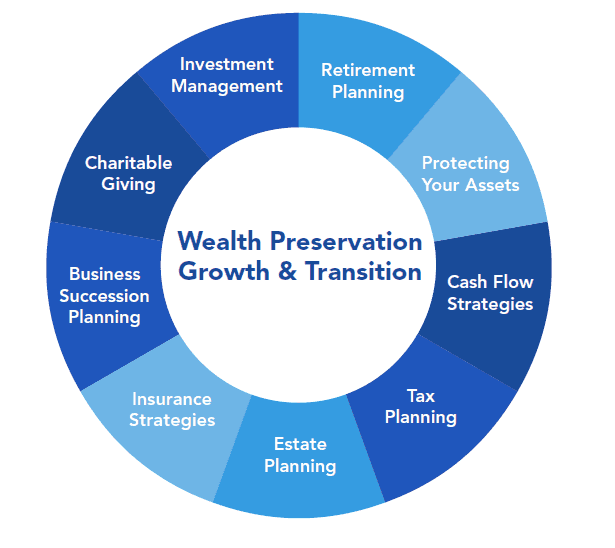

Financial Planning

Financial planning is more than just investing today and hoping for the best return tomorrow. It involves a comprehensive look at your complete financial picture, including your current needs and retirement goals, in order to develop a customized strategy that completely fits your lifestyle both now and in the future.

Our portfolio managers will only recommend public, private, or alternative investment products that suit your comfort level, whether it’s conservative, reasonable, or aggressive. We integrate rational, educated assumptions into your financial plan, such as inflation rate, life expectancy, and retirement benefits and spending so your plan will continue to operate efficiently over the long term, even during lean times.

We’ll also prepare you for your dream retirement, and recommend the best cash flow strategy for your vintage years. Our proactive approach includes a look at where your cash will be coming from, such as registered investments, TFSAs, or pensions, explore spousal income splitting options, and review your future plans for downsizing or selling your principal residence.

Count on the team at Access Private Wealth to look at every possible strategy that will grow your wealth so your family is ready for the future.

Tax & Financial Planning in Toronto, Mississauga, Ancaster and Southern Ontario.

You’ve worked hard for your money and invested wisely. Keep more of your capital and income for yourself with tax and financial planning solutions from Access Private Wealth. Just ask our financial experts how we can increase your family’s wealth with a tax-efficient strategy that’s completely tailored to your needs and goals.