Integrated Tax & Financial Planning

Offered by Access Private Wealth Corp.

The Access Formula

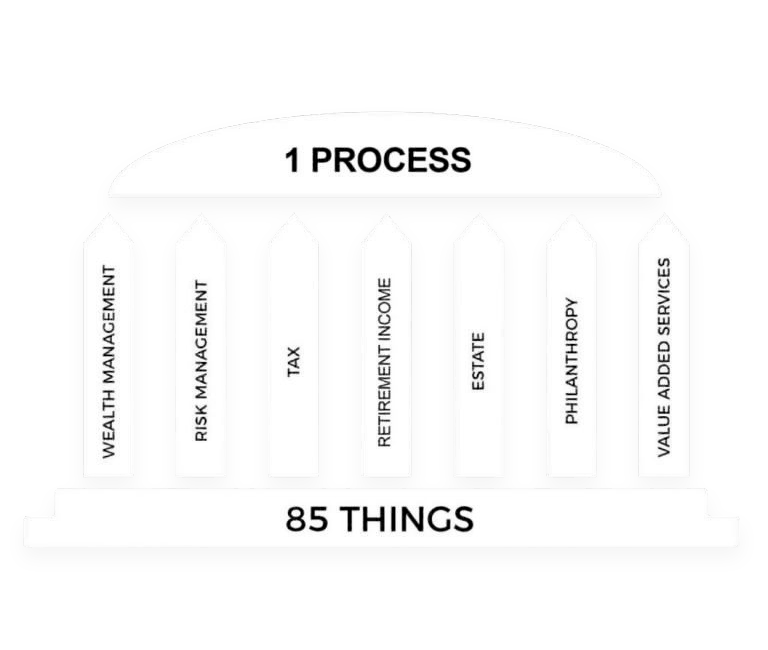

Managing wealth involves far more than holding investment accounts. The Access Formula is our proprietary planning framework, developed and refined to integrate every aspect of a client’s financial life as circumstances evolve over time.

Built on seven core financial pillars, the Access Formula provides a structured yet flexible approach – guiding clients through life’s critical transitions while maintaining clarity, continuity, and alignment across every financial decision. It is a long-term, relationship-driven process, not a static or transactional one.

By focusing on the broader objectives and long-term picture, clients gain confidence in the direction of their wealth while we manage the underlying complexity.

Tax Planning

Tax planning is a critical component of long-term wealth management. Our approach focuses on understanding how tax considerations intersect with your broader financial structure. We assess the tax efficiency of registered and non-registered accounts, investment income, and cash flow, and identify opportunities to improve coordination and after-tax outcomes within a disciplined planning framework.

Working alongside your existing tax and legal advisors – or introducing trusted professionals where appropriate – Access Private Wealth Corp. helps ensure tax strategies are aligned with your overall financial, estate, and legacy objectives.

Our tax planning strategies include advice and guidance on:

- Income splitting to reduce income taxes

- Pension splitting with your spouse on your tax return

- Sharing CPP benefits and RRSP contributions

- Registered Education Savings Plans (RESP)

- Registered Disability Savings Plans (RDSP)

- Graduated Rate Estates (GREs)

- Prescribed rate loans

- Family trusts

- Strategies for splitting business income

We can also provide you with handy tips to save even more tax, such as deducting interest on investment or business loans, investment counsel fees, capital gains exemptions, and more.

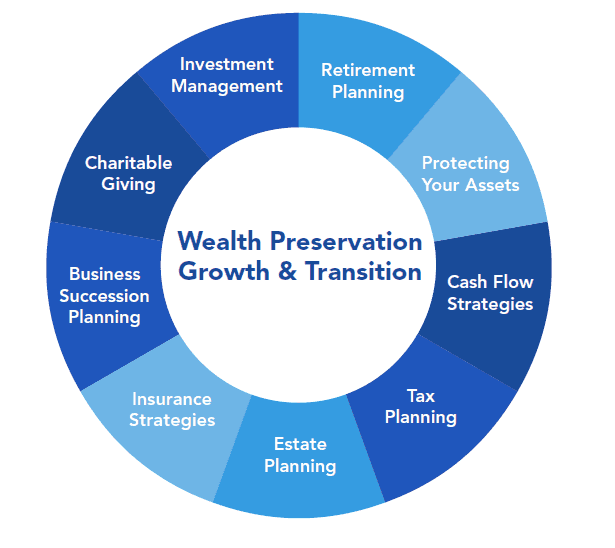

Financial Planning

Financial planning extends beyond investment selection. It involves a comprehensive assessment of your overall financial structure – balancing current priorities with long-term objectives – to support informed decision-making over time.

Our planning process incorporates realistic, disciplined assumptions around factors such as inflation, longevity, retirement income, and spending needs. Investment recommendations are made within this broader context and aligned with each client’s objectives, risk tolerance, and time horizon.

The result is a structured, adaptable plan designed to remain relevant through changing market conditions and life circumstances.

Retirement planning focuses on ensuring financial flexibility and sustainability over time. We help clients evaluate future cash flow needs and develop strategies for drawing income efficiently and intentionally throughout retirement. This includes assessing the optimal sequencing of registered and non-registered assets, TFSAs, pensions, and other income sources like CPP and OAS, as well as reviewing opportunities for income splitting where appropriate. We also consider longer-term decisions such as downsizing or the potential sale of a principal residence to ensure retirement plans remain coordinated and adaptable.

Count on the team at Access Private Wealth Corp. to evaluate appropriate strategies within a disciplined planning framework - supporting long-term objectives and helping families prepare for the future with clarity and confidence.

Tax & Financial Planning in Toronto, Mississauga, Ancaster and Southern Ontario.

You’ve worked hard for your money and invested wisely. Keep more of your capital and income for yourself with tax and financial planning solutions from Access Private Wealth. Just ask our financial experts how we can increase your family’s wealth with a tax-efficient strategy that’s completely tailored to your needs and goals.